See what a $100,000 salary looks like after taxes in Alabama

A six figure salary sounds like a lot of money – and it is. Just how much you will actually have at your disposal, however, varies based on where you live.

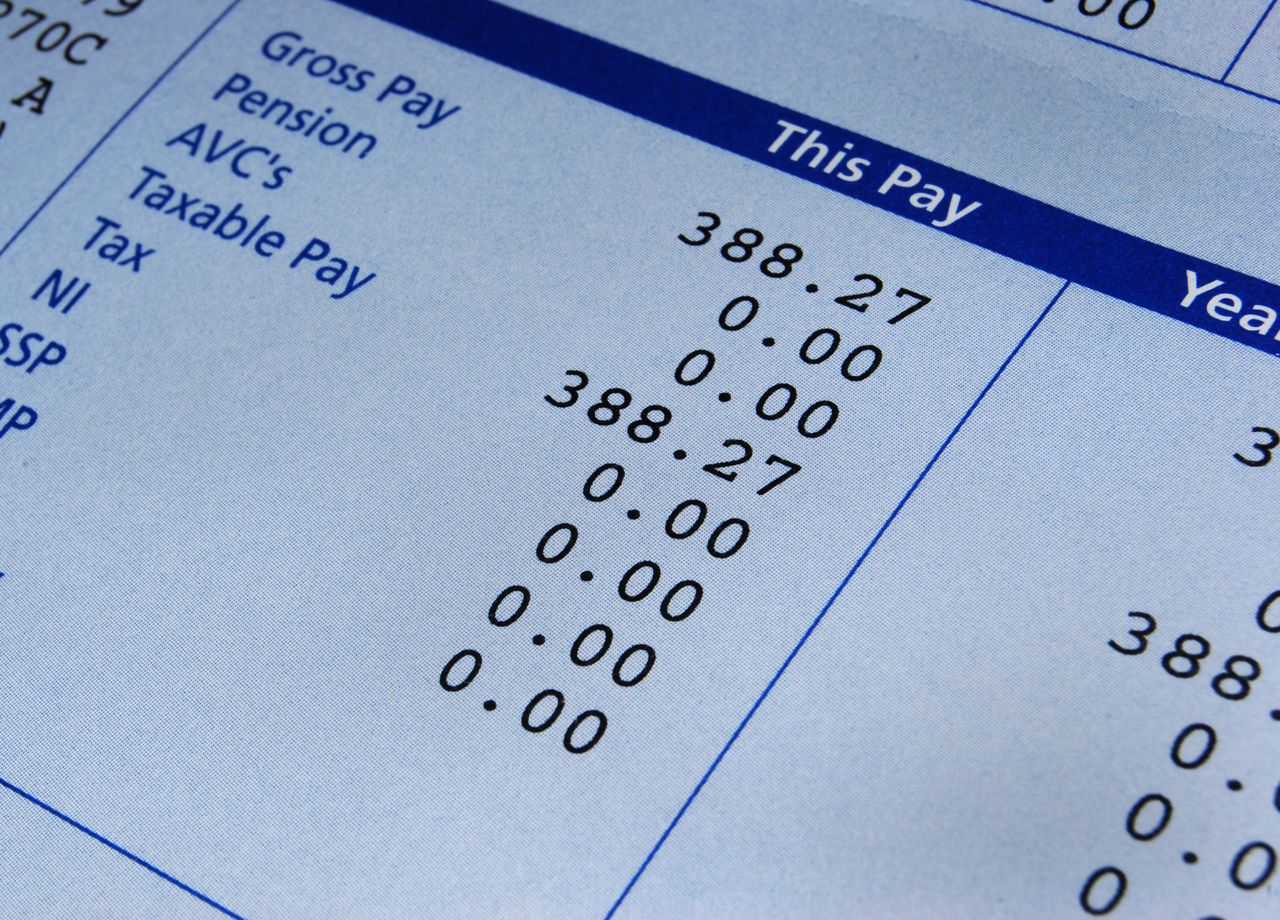

Federal taxes take a bite into that $100,000 as does FICA deductions, social security taxes, and depending on where you live, state and local taxes. To determine how much of a $100,000 salary really looks like in each state, GoBankingRates.com pulled data from federal and state tax brackets using information from the Tax Foundation. The site then used an income tax calculator to find both effective and marginal tax rate on income of $100,000 for a person filing taxes as a single person and for a married couple.

Here’s what they found for Alabama:

Alabama

- Take-home salary for single filers: $73,254

- Take-home salary for married filers: $79,569

“In Alabama, residents are allowed to deduct their federal income taxes, helping to keep the state in the bottom half of taxes owed across the United States. Still, a single filer will pay $26,746 in taxes,” the site noted.

The amounts shown don’t include deductions for things like health insurance, so the actual amount brought home is likely lower.

Want to see how other states stack up? You can compare here.