Powerball hits $1.2 billion: What winner would take home after taxes

The Powerball jackpot just keeps growing and growing.

The jackpot now stands at $1.2 billion with a cash option of $596.7 million for the next drawing on Wednesday, Nov .2.

“This is the largest Powerball prize in more than six years,” said Drew Svitko, Powerball Product Group Chair and Pennsylvania Lottery Executive Director. “The jackpot is getting bigger with every ticket sold.”

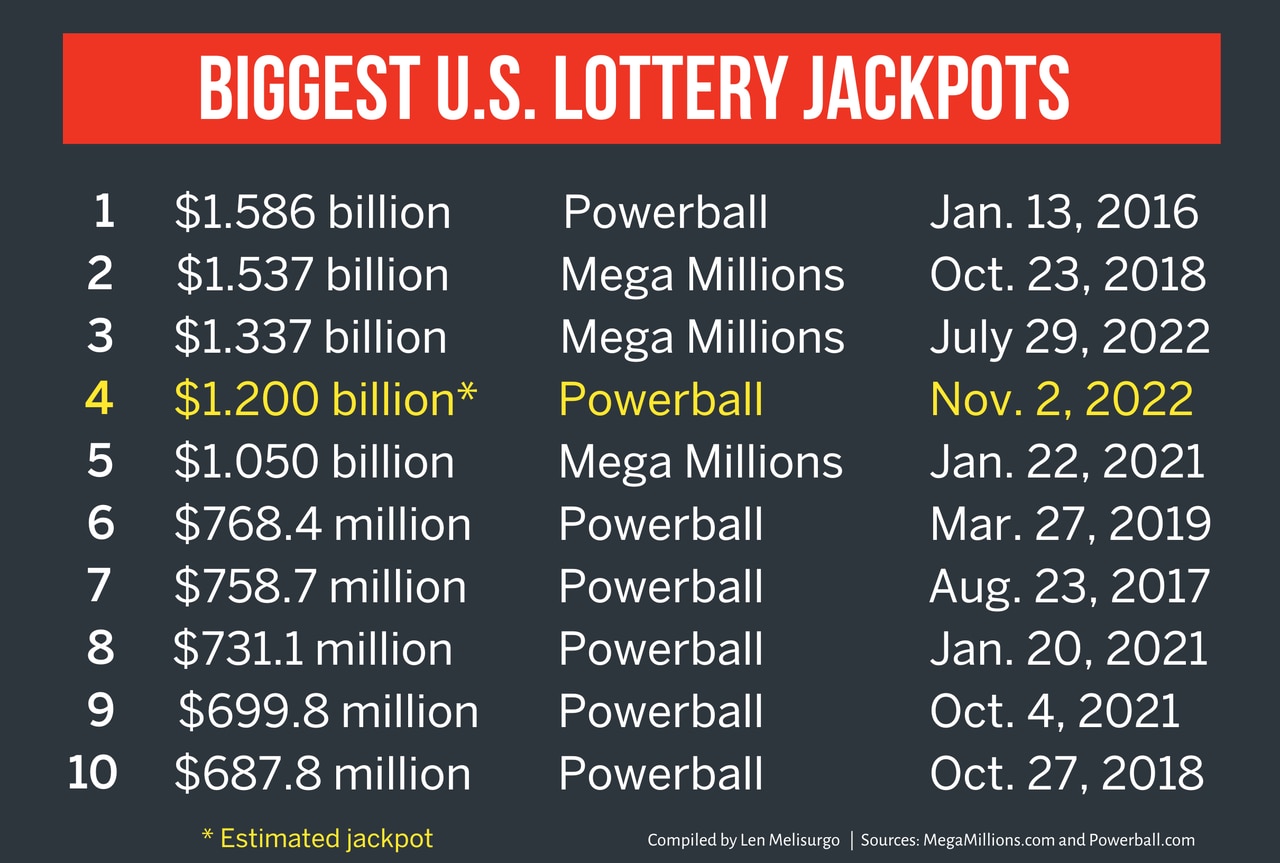

If a player wins Wednesday’s jackpot, it will be the second-largest jackpot in Powerball’s 30-year history and fourth-largest jackpot in U.S. lottery history.

The next Powerball drawing will take place at the Florida Lottery draw studio in Tallahassee at 10:59 p.m. ET (9:59 p.m. CT). Ticket sale cut-off times vary by jurisdiction, but typically occur 1-2 hours before the scheduled drawing.

The odds of winning the jackpot are 1 in 292.2 million.

READ MORE: $1 million Powerball ticket sold at Flora-Bama Liquor & Lottery

How much would you pay in taxes?

Jackpot winners can choose their prize as an annuity, paid in 30 graduated payments over 29 years, or as a lump cash sum.

No matter which you choose, Uncle Sam will get his share.

According to fool.com, a total of 24% of your winnings will be withheld under federal law but the sudden windfall would actually bump your tax bracket up to 37% – the highest tax rate assessed by the federal government. That means you have to pay the difference between 24% and 37%.

The site’s analysis shows the winner will get $367,899,840 if they opt for the lump sum payment or $756,000,000 for the annuity – before state taxes.

Eight states – California, Florida, New Hampshire, South Dakota, Tennessee, Texas, Washington and Wyoming – charge no taxes on lottery winnings. In Alabama, despite not participating in the Powerball lottery, will hit you for another 5% in taxes even though the ticket was bought elsewhere.

So what will you end up with? A lot. The tax estimates are rough and not considering charitable donations or other factors but whoever wins, we know this – the government will get its share.