Montgomery woman guilty of $610,000 Paycheck Protection Program fraud

A Montgomery woman was convicted by a federal jury Wednesday of defrauding the Paycheck Protection Program of nearly $610,000, prosecutors said.

Zsa Zsa Bouvier Couch, 55, was found guilty of multiple county of bank fraud, making false statements to a federally insured bank and money laundering, said Sandra J. Stewart, U.S. attorney for the Middle District of Alabama.

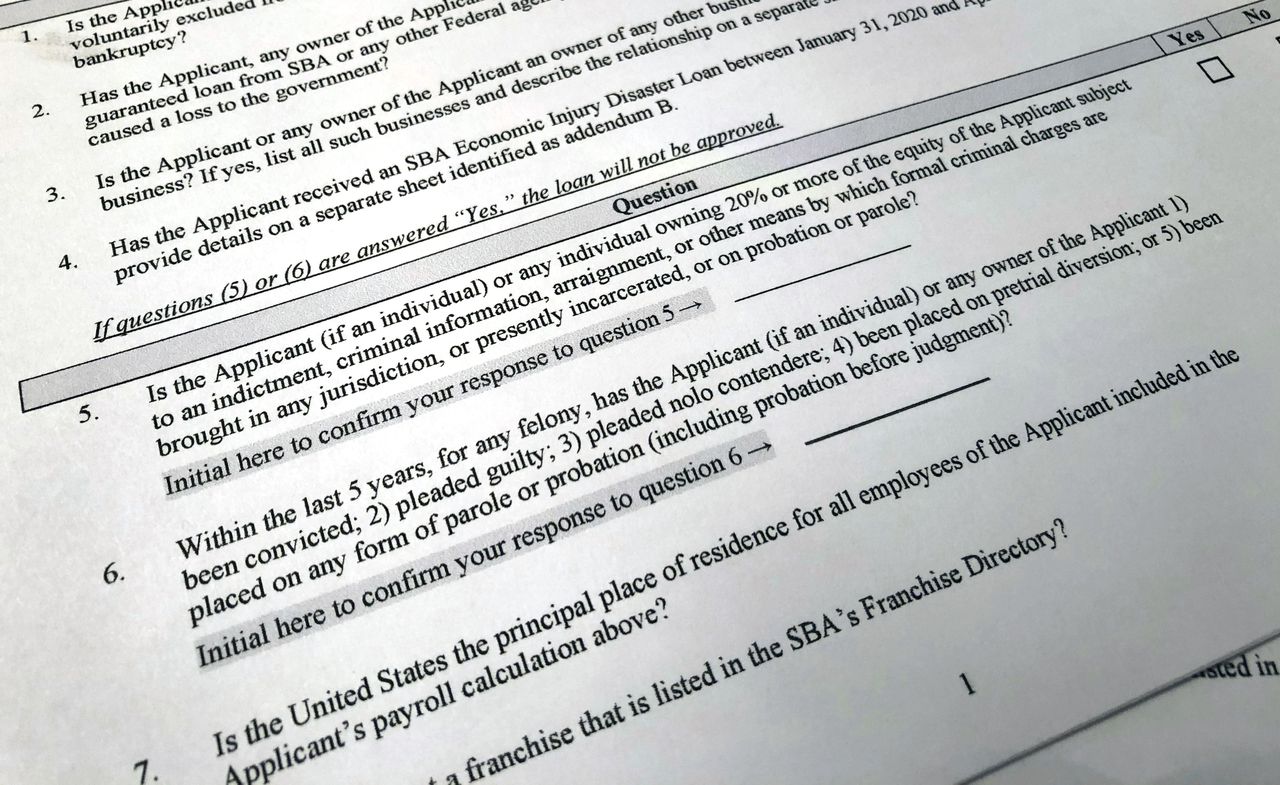

Couch submitted at least six fraudulent applications for loans under the PPP and sought $1.6 million in program funds.

In each application, the Montgomery woman falsely inflated the number of employees who worked for her purported business and the business’ average monthly payroll, according to prosecutors.

The false statements led Couch to qualify for larger PPP amounts than she was eligible to receive.

Ultimately, Couch received $609,687.47 in PPP funds.

Instead of using the money for a business, she instead used the cash to pay herself, her husband and other family members and buy luxury vehicles.

Couch made other false statements on the applications, including omitting that she applied for multiple PPP loans for the same business. She also did not discluse her common ownership of multiple businesses.

“The United States Attorney’s Office is committed to detecting, investigating, and prosecuting individuals who exploit public benefit programs,” said Stewart. “My office will continue to work with law enforcement partners to safeguard all tax dollars, especially programs dedicated to help businesses deal with economic hardships during times of crisis.”

“This conviction underscores our unwavering commitment to upholding the rule of law and ensuring that those who engage in fraudulent activities meant to exploit the CARES Act’s provisions are held accountable for their actions,” added Paul Brown, special agent in charge with the FBI’s Mobile office. “This accomplishment would not have been possible without the dedication and hard work of our law enforcement partners. We understand the significance of CARES Act funds in supporting individuals and businesses during these challenging times, and we will continue to be vigilant in our efforts to hold accountable any individuals or entities engaged in fraudulent activities related to CARES Act relief programs.”