Lawmakers enter session with big choices on budgets, taxes, education

Alabama lawmakers begin their annual session this week facing decisions about how to use billions of dollars on top of the state budgets they must approve every year.

That includes $2.7 billion for education that taxpayers pumped into state coffers last year in excess of the budget. And it includes $1.1 billion from the American Rescue Plan Act (ARPA), which Congress passed two years ago to help states recover from the COVID pandemic.

Legislators are expected to consider using a portion of the education revenue surplus for a tax rebate, or one-time payment to taxpayers. There is likely to be discussion about eliminating the sales tax on groceries, an idea talked about for years but one that has never come close to passing.

A bill to create education savings accounts to allow parents to use taxpayer dollars to send their children to private schools will be one of the education proposals.

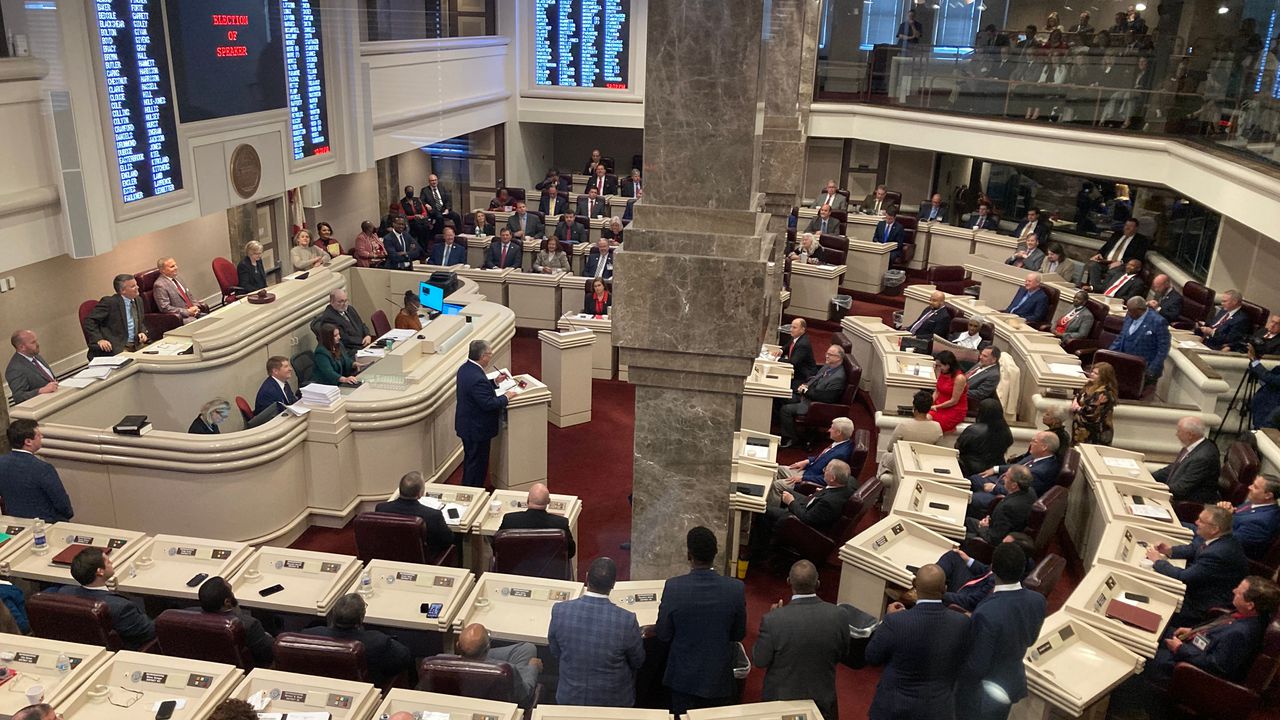

The Legislature, newly elected in November, includes a large freshman class, including 31 members of the 105-seat House of Representatives. The session begins at noon Tuesday and can last up to 15 weeks.

Gov. Kay Ivey will reveal her priorities during her State of the State address Tuesday night. Ivey is beginning her second full term after winning a landslide election in November.

Top three priorities

Senate President Pro Tem Greg Reed, R-Jasper, said the three biggest priorities are the ARPA funds, renewal of the economic incentive laws Alabama uses to recruit industry, and the state budgets, including how to use the surplus.

“I think number one is going to be ARPA,” Reed said. “We’ve got $1.1 billion that we’re going to need to appropriate. That’s going to be huge.”

The Alabama Jobs Act, which provides qualifying businesses that create new jobs a tax rebate based on their payroll, is a key economic incentive law that is due to expire in July.

“That’s very important to our economy and our continued economic and industrial growth. That’s a big deal,” Reed said.

The state Constitution requires the Legislature to pass the budgets, and this year that includes decisions about how to use extra revenue.

“We have surplus resources in both the education and General Fund budgets,” Reed said. “And understanding what to do with those resources as well as the appropriate budgeting process is going to be something that is a big, big deal to members of the body.”

House Minority Leader Anthony Daniels, D-Huntsville, said the Democratic caucus will support two proposals aimed at helping families with rising costs. Daniels will sponsor a bill to eliminate the state income tax on overtime pay. In addition to allowing employees to keep more of the money they earn, Daniels said the idea would help employers who are struggling to find workers.

“We wanted to do something that will allow workers an opportunity to be able to bring home more money, which will help them personally, but it also will increase productivity at the same time,” Daniels said.

Daniels said the caucus will support repealing the state sales tax on groceries, which is 4 percent, same as the general sales tax rate. Lawmakers and advocacy groups have proposed the idea for decades, pointing out that most other states don’t collect their full sales tax on purchases of necessities. But no bill has come close to passing, mainly because of the expected loss to the Education Trust Fund. The tax on groceries generates close to $500 million a year for the ETF.

Daniels said the loss of revenue from repealing the tax on groceries would be offset, at least to some degree, because households would spend the money they save on grocery taxes on other products that carry the sales tax.

“If a person is saving at the grocery store they’re spending money in other places,” Daniels said. “So therefore that savings ends up being used in other areas where we’re generating tax dollars anyway.”

Daniels suggested the state could approve a “holiday” for grocery taxes, such as suspending them for a one-month period. He said that could help assess the impact on the Education Trust Fund.

House Speaker Pro Tem Chris Pringle, R-Mobile, said he would be reluctant to support an overall repeal of the sales tax on groceries. Pringle said he would prefer a targeted repeal, taking the tax off necessities like milk, eggs, and cheese, but not from snacks that contribute to obesity and the state’s high rankings on chronic public health problems.

“Why do you make it cheaper for people to go buy Coca-Colas, and potato chips and cookies and ice cream?” Pringle said. “You want to talk about taking the tax off food that we need, good healthy food, we can talk about that. But taking the tax off junk food?”

Pringle said he expected the idea of repealing the grocery tax to be discussed in depth during the session.

Education surplus

Lawmakers and education officials have floated proposals on how to use the $2.7 billion in unexpected education revenues, which are the result of unusually large growth in income taxes and sales taxes collected by the state, the largest components of the Education Trust Fund. The billions of dollars of federal money sent to the state through COVID-19 relief plans like ARPA and the CARES Act and inflation have been cited as reasons for the surplus.

Sen. Arthur Orr, R-Decatur, chairman of the Finance and Taxation Education Committee, suggested allocating the money to three main purposes — a tax rebate, a one-time payment to taxpayers; a fund to support building projects for public schools and colleges; and a new savings account for the Education Trust Fund that lawmakers could tap to sustain funding in key programs when education revenues taper off.

Reed said he expects all those ideas to be in the mix.

“Number one, a rebate idea,” Reed said. “Is there an opportunity for giving a rebate back to taxpayers, those that are sending money to state budgets? Would there be in that surplus a portion of that be given back to the people that sent the money? I think that’s a big discussion.”

Education budget chairman Orr has suggested a rebate in the neighborhood of $500 million. He estimated rebates could potentially be in the range of $200 to $250 for individual state income tax filers, and double that for households filing jointly.

House minority leader Daniels said a rebate is not his first priority for how to use the funding surplus, saying he thought the money should be better used for investments that could improve education.

It’s not unusual for the state to take in more revenue than it budgeted. Every year, that money goes to a stabilization fund to hold for leaner times and an advancement and technology fund that can be used for certain purposes. But it was extraordinary to have more than $2 billion left over last year.

Pringle said lawmakers have to be careful in how they use the surplus because it won’t last and leaner times are ahead, a point made repeatedly by legislative leaders.

“The surplus we have will not last,” Pringle said. “It will go away. This economy is going to downturn. And when it does, we’re going to be short on money again. So we need to be very careful what precedents we set. Our number one responsibility is to balance those budgets.”

During budget hearings the Legislature held in February, State Superintendent Eric Mackey proposed using $500 million of the surplus for capital projects for K-12 schools. The Legislature passed a $1.25 billion bond issue for school construction in 2020,during the early portion of the COVID-19 pandemic. But Mackey said school systems need a supplement to that because of the sharp rise in construction costs. Orr made the same point. Orr’s idea is to use $500 million to $750 million for capital projects to cover K-12 schools and state colleges and universities.

Senate Pro Tem Reed said it makes sense for that to be part of the considerations on how to use the surplus.

“You’ve got a lot of school boards that have got programs going on construction issues,” Reed said. “And now in the midst of that construction, you’re looking at 70 cents on the dollar with the difficulties in the construction industry and the cost of supplies and supply chain.”

The Alabama Board of Education’s budget request to the Legislature calls for an $894 million increase for K-12 schools, to $6.2 billion. That includes $264 million to add 3,000 teachers statewide.

Read more: ‘Modest’ pay raise plus 3,000 more teachers, expanded preschool pitched in Alabama school budgets

Alabama faces decisions about how to use $2.7 billion in unexpected education funds

School choice

Sen. Larry Stutts, R-Tuscumbia, is proposing a bill to allow parents to use about $6,000 a year in state tax dollars to send their children to private schools through education savings accounts, or ESAs.

Supporters of the idea say parents have a right to decide where their children attend school. They say that since parents pay taxes to help support public education, they should have access to a portion of state funds to help them pay for their children to attend private school, home school, or a public school other than where they are zoned. The bill is called the Parental Rights in Children’s Education Act, or PRICE Act.

Ten states have ESA programs according to Ed Choice, which supports and tracks school choice programs. The Alabama Legislature considered an ESA bill last year. The bill stalled after winning committee approval in the Senate.

State Superintendent Mackey said private schools that accept the education savings account funds to enroll children should be required to give the standardized tests that public schools give to assess how well students are learning.

“I’m not saying parents can’t (choose) a private school or a parochial school,” Mackey said last month after speaking to lawmakers during a budget hearing. “That’s a parent’s responsibility. A parent choice. But if the state’s going to pay for that education, then the state needs to know what it’s getting for its money. And parents need to know how to make an informed choice. So let them take the state test so parents can see, is this school actually performing better, worse than the public school.”

Stutts said he will introduce his bill early in the session. House Minority leader Daniels is opposed to the idea of using tax dollars to help children go to private school.

“This is basically an upper middle class tax cut,” Daniels said. “This does nothing for our underperforming schools. It does nothing to solve the education problems in the state of Alabama. As a parent, I have a choice already. I have a choice to utilize services that are available for me or I have a choice to make investments in my child’s education to go to private school. That is a choice. And my choice for doing that as a parent is already there.”

Senate President Pro Tem Reed said he expects the PRICE Act to get discussion. He expects other proposals related to school choice, including ideas to increase participation in charter schools and the Alabama Accountability Act.

Alabama first authorized charter schools in 2015. The Alabama Accountability, passed in 2013, created scholarships that parents could use for private school that are funded by donors who receive a credit on their state income taxes.

“Is there a way for more participation in those programs?” Reed said. “I think that’s the goal. Are there ways to expand those programs in a way that they become something that’s more of an option in choices to families, different communities, especially in areas to where you’ve got schools that are not performing well?”

Criminal justice

Alabama lawmakers will consider some issues related to the state’s overcrowded and understaffed prison system, which faces a lawsuit from the Department of Justice alleging that the prisons are so unsafe that they violate the Constitution. The state has grappled with the problems for years.

Lawmakers passed a criminal justice reform bill in 2015 intended to send fewer nonviolent offenders to prison. Alabama prosecutors say some of that law has had unintended consequences and will support legislation to give judges more authority to sentence low-level felony offenders to prison. The Alabama District Attorneys Association is seeking that change as well as a bill to require mandatory prison time for felons that violate prohibitions on having guns because of their criminal records or that use guns to commit crimes. Prosecutors say those changes are needed to fight back against the rise in violent crimes.

Read more: Alabama prosecutors want mandatory prison for felons who violate gun prohibitions

Rep. April Weaver, a Republican who represents Shelby, Chilton, and Bibb counties, has proposed a bill to reduce good time benefits for Alabama prisoners, which is intended to allow them to reduce how much time they serve if they follow the rules in prison. Some inmates serving 15 years or less are eligible to earn up to 75 days good time for every 30 days they serve. The Alabama Department of Corrections said in January that about 14 percent of the state’s approximately 20,000 inmates were eligible for good time, which is officially called correctional incentive time.

Weaver named her bill after Bibb County Deputy Brad Johnson, who was fatally shot in 2022 near her home. The man accused of killing Johnson had accumulated more than 2,000 days of good time when he escaped from a work release center.

House Speaker Pro Tem Pringle predicted that Weaver’s bill would pass and reduce what he said was the nation’s most generous good time law. Asked how that would affect the overcrowded prisons, Pringle said, ’That’s the reason why we’re building new prisons. You’ve got to put criminals in jail.”

Alabama lawmakers and Ivey approved a plan to build two 4,000-bed prisons for men in 2021 at an estimated cost of $1.3 billion. Officials say those prisons, in Elmore and Escambia counties, will be finished in 2026. Older Alabama prisons are expected to close, so officials have said the new prisons aren’t intended to increase the overall capacity of the state system.

Eighty percent of Alabama inmates are in prison for what are considered violent offenses, according to the Alabama Sentencing Commission’s annual report for 2023.

“These are not people that need to be let our early,” Pringle said. “They need to serve their sentence for what they did on victims.”

Critics of cutting back the good time law, including the ACLU of Alabama, say it will make prison conditions worse and reduce incentives for inmates to change their behavior. “This bill will further entrench our state in the issues pervading Alabama’s overcrowded and unconstitutional prisons. Limiting ‘good time’ is not in the interest of public safety, as the sponsor is purporting,” Dillon Nettles, the ACLU’s Policy and Advocacy director, told the Associated Press.

Lottery and casinos

Lawmakers propose bills to establish a state lottery every year. Any bill to expand gambling in Alabama requires an amendment to the state constitution, which takes a three-fifths vote in the House and Senate and then approval by voters. Lawmakers have not passed a lottery bill since 1999, when voters rejected Gov. Don Siegelman’s proposed lottery by a vote of 54 percent to 46 percent.

Two years ago, the Senate passed a bill proposing a constitutional amendment for a lottery, casinos, and sports betting, a plan supported by Gov. Ivey, who has said it is past time for voters to have a chance to settle gambling issues in Alabama. The Senate passed the bill but it died in the House.

The sponsor, Sen. Greg Albritton, R-Atmore, remains a proponent of the idea but has said he does not plan to push a bill this year unless the House moves on it first. Otherwise, he said it would be a wasted effort. The House sponsor of his bill two years ago, Rep. Chris Blackshear, R-Phenix City, has said he has no definite plans to pursue a bill this year.

Senate Pro Tem Reed said there is always interest in gaming legislation but said there is less talk about it this year than in some previous years.

“I’m just not hearing it as big a priority this year as has been the case in some other years,” Reed said. “That could change once we get into the session and there be more reason for people to begin talking about it. But just in assessing topics that I feel like are of paramount importance to legislators, I just don’t hear the gaming topic being discussed as some of the other priority issues that we’ve already talked about.”

Read more: Bills to allow votes on Alabama lottery, casinos, might be on hold for another year

ARPA funds

Alabama has $1.1 bill remaining to allocate from the American Rescue Plan Act, which Congress passed to help states and local governments, businesses, and families recover from the economic fallout and health care costs of the pandemic.

Last year, Ivey called a special session for the state to allocate the first $1.1 billion. That came after broad agreement from both parties about how to spend the money, and the plan passed with no opposition.

The biggest portions were $277 million to expand access to high-speed, broadband internet, $225 million for water and sewer infrastructure projects, and $80 million for hospitals and nursing homes.

Earlier, during a special session in 2021, lawmakers approved using $400 million in ARPA funds to help build the two new men’s prisons.

This year, Reed said he expects broadband access, water and sewer projects, and hospitals and nursing homes to again be priorities for the ARPA funds. He said the approach is the same as last year, trying to make sure the money is used to address needs that will not go away.

“That’s an attitude of trying to make sure that we spend those monies in a way that are important for ongoing benefit,” Reed. “That we don’t just spend them for something that’s going to be spent and then gone.”