Hate bank overdraft fees? New proposal would slash them to as low as $3

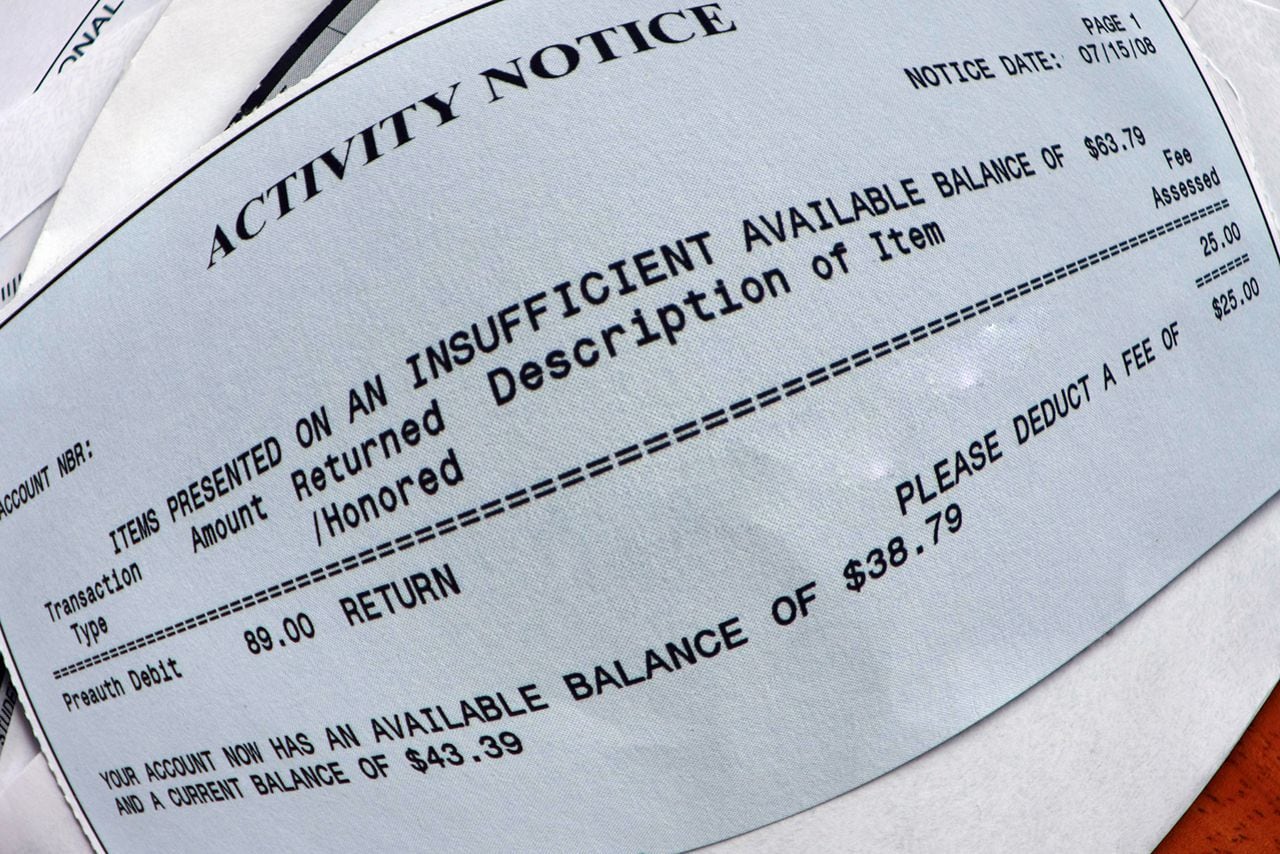

The dreaded – and often inflated- overdraft fee charged by banks could soon be a thing of the past.

The Consumer Financial Protection Bureau has proposed a rule that would apply to banks and credit unions with more than $10 billion in assets or approximately 175 of the largest financial institutions in the country, Yahoo Finance reported. The proposal would require large to mid-size banks to calculate and disclose an annual percentage rate for each overdraft fee.

Or, banks would have fees capped to recoup their costs or use a benchmark set by the bureau of $3, $6, $7 or $14. CFPB is accepting comments on the proposal now.

“Decades ago, overdraft loans got special treatment to make it easier for banks to cover paper checks that were often sent through the mail,” CFPB Director Rohit Chopra said in a statement. “We are proposing rules to close a longstanding loophole that allowed many large banks to transform overdraft into a massive junk fee harvesting machine.”

Current overdraft fees are about $35, CFPB said, even though the majority of consumers’ debit card overdrafts are for less than $26 and are repaid within three days.

The change would close a loophole in the 1969 Truth in Lending Act that exempted overdraft fees from consumer protections. The rule could save consumers some $3.5 billion or more in fees per year, or about $150 per household for the 23 million households who pay overdraft fees in a given year, CFPB said.