Birmingham-Southern College disputes state treasurerâs claims

Birmingham-Southern College issued a statement on Monday disputing claims by State Treasurer Young Boozer, escalating the war of words with the state official who denied the private college a $30 million state loan that it said it needed to avoid closure.

On Wednesday, BSC’s lawsuit against Boozer was dismissed. “While the Alabama Constitution provides for immunity to state officials, such immunity should not apply to those who act arbitrarily or capriciously, or in bad faith, or who have misinterpreted the law in question,” BSC President Daniel Coleman said after the dismissal. “Our good faith was betrayed over the several months of working with Treasurer Boozer to deliver this bridge loan to the College.”

On Friday, Coleman sent a letter to supporters saying the college was exploring “every option for the future of this college.”

Over the weekend, Boozer responded to allegations from Coleman that Boozer had acted in bad faith and compared the school’s standing to “a junk bond, one step above default.”

Boozer also took issue with the accusation that he’d said BSC was “not a good credit risk.” In a statement issued Sunday, he specified that his actual stated position is that it is a “terrible credit risk.”

Coleman released a statement today saying Boozer “at least owes Alabamians the full and honest truth.”

He once again disputed Boozer’s interpretation of events that led to denial of the loan.

“We are uncertain why the treasurer has mischaracterized the events of the past several months,” the statement from BSC today said. “Certainly, the treasurer has many duties for which he is responsible, but for months now the question of a loan for BSC has been the primary preoccupation of the college administration.”

The latest statement gave BSC’s version of events with a timeline of interactions with the treasurer.

Here is the full text of the statement released by Coleman’s office on Monday:

Birmingham-Southern College Response to State Treasurer Boozer’s Statement

In a news release issued on October 29, 2023, Alabama State Treasurer Young J. Boozer II misstates the series of events that led Birmingham-Southern College to its present circumstances. The Treasurer claims to have informed the College “months ago” that it would not qualify for a loan under the Distressed Institutions of Higher Learning Revolving Loan Fund Act. That and many other assertions are simply not factually accurate.

Following is BSC’s response, including key events, dates, and interactions.

The Loan Qualifications

The Treasurer has provided inconsistent statements on his refusal to make the loan.

The Treasurer has said BSC did not qualify for the loan under the Act, which is inaccurate. The requirements include:

- Has operated for more than 50 years in Alabama.

- Founded as Southern University in 1856, BSC has operated for 167 years.

- Has a significant impact on the community in which it is located.

- The College has an economic impact of $70.5 million per year in Jefferson County and $97.2 million statewide.

- BSC has educated a disproportionate share of physicians, dentists, lawyers, business and civic leaders, educators, and other professionals who live, work, serve, and pay taxes in every county in the state.

- BSC also serves as a partner to and anchor for the historic neighborhoods of Bush Hills and College Hills that surround the 192-acre campus.

- BSC caused the payment of $13.8 million in state and local taxes last year, so BSC would pay more than $40 million in such taxes over the next three years.

- Has assets sufficient to pledge as collateral.

- The College offered the State a first secured position in collateral that exceeds several times the amount of the proposed $30 million loan, including its 192-acre campus in west Birmingham and U.S. Treasury securities.

‘Terrible Credit Risk’

The Treasurer has also said the reason he denied the loan is because BSC is a “terrible credit risk,” a fact not in dispute and in fact was the impetus for the legislation, which he lobbied against before its passage.

If a college or university had an A rating from Moody’s or an excellent credit rating or the ability to borrow more from a bank, that institution would not qualify for the Distressed Institutions of Higher Learning Revolving Loan Fund because it would not be “distressed.”

But because BSC is distressed, the Treasurer says the College does not qualify.

Collateral Position

The Treasurer has also said the denial was because BSC had not provided the State with a first position on all collateral assets securing the loan. As the College’s primary lender, ServisFirst holds a first-priority interest in BSC’s collateral and had agreed to restructure its loan in a manner that would allow for the State to have a first lien on the collateral for its loan.

BSC has presented two proposals – one on Sept. 26 and another on October 12 – both of which provided the State with a first position in the collateral assets securing the loan. The Treasurer rejected both proposals and has refused to make a counter proposal.

Proposal 1 (presented to the Treasurer on September 26):

The State would receive as collateral a first secured position on the entire campus except for Hilltop Apartments and the Consolidated Pipe and Supply Co. headquarters, located on campus and owned by the College.

- First draw = $16 million. The campus without Hilltop Apartments and the Consolidated Pipe headquarters appraises for about $75 million, over 400% of the amount of the first draw. This is like a bank lending money to someone to buy a house with 79% down payment.

- Second draw = $9 million. This would have been collateralized with U.S. Treasuries from donors.

- The interest on the U.S. Treasuries would go to the College. The Treasuries would go to the BSC Foundation when the loan is paid back.

- Third draw= $5 million. This would have been collateralized with U.S. Treasuries from donors.

- The interest from the U.S. Treasuries would go to the College. The Treasuries would go to the BSC Foundation when the loan is paid back.

- Moreover, BSC would release the campus as collateral before the Treasuries, implying that in about 10 years, the State would be 100% secured by Treasuries.

Proposal 2 (presented to the Treasurer on October 12):

On Day 1, the State would receive as collateral a first secured position in the entire campus except for Hilltop Apartments but including the Consolidated Pipe headquarters. The State would also receive as collateral a first secured position in the Hilltop Apartments prior to the second-year draw.

- First draw = $16 million. The campus without Hilltop Apartments but including Consolidated Pipe appraises for about $77 million. This is like a bank lending money to someone to buy a house with 80% down payment.

- Second draw = $9 million. This only happens if BSC provides as additional collateral to the State a first secured position in the Hilltop Apartments. If the apartments appraise at approximately $17.5 million, then the State has loaned $25 million against $94.5 million in assets, like lending to someone to buy a house with 73.5% down.

- Third draw = $5 million. No more collateral to be posted. The loan is about $30 million (slightly higher because it grows at 1% per year until we start servicing the debt in 2029).

- At this point, BSC will have borrowed about $30 million against collateral of about $94.5 million, buying a house with a 68% down payment.

- In this scenario, the State has all of the collateral assets.

The Bond Rating

In an October 29 story on al.com, the Treasurer cited BSC’s bond rating as the reason for denial, although bonds had not previously been discussed.

However, the Distressed Institutions of Higher Learning Revolving Loan Fund has no criterion based on bond ratings of applicants. Even if it did, the bonds referred to by the rating agencies do not have the collateral that was offered to the State, which was more than sufficient to protect the State in case of default. “Junk bonds” – to which the Treasurer compared BSC’s bond status — are not backed with U.S. Treasuries and assets valued at 4.5 times the initial draw on the requested loan. The rating agencies would not have seen BSC’s financial restructuring plan, which will put the College back on its feet by academic year 2026-2027.

The Treasurer saw that restructuring plan in May, even before the bill was passed.

BSC has presented two proposals that put the State in the best possible position for payback of the loan that will keep the College open. We have been fully transparent about our challenges – how we got here, what it will take to move forward, what we can offer to ensure the State is protected, and how we will make sure we are never in this position again.

Actions and Inactions

A timeline of key interactions between BSC and the Treasurer reinforces the College’s contention that the Treasurer intentionally executed a veto by delay. Given his statements, actions, and inactions from the time the bill was passed in June until his denial letter was received on October 18, it is clear that the Treasurer never intended to make the loan, which raises the question of why he did not communicate that decision to BSC right away.

If he had, it would have been heartbreaking news, but the timing would have avoided the catastrophic impact of his delaying until mid-October.

- In July 2022, President Daniel Coleman meets with State Treasurer Young J. Boozer III to discuss possible ways the State can help BSC obtain bridge funding. The two meet again in February 2023, after BSC has exhausted efforts to obtain funding from the State’s American Rescue Plan Act allocation.

- In April 2023, BSC’s Board of Trustees receives assurance from legislative leaders that should the measure they are supporting pass, the College would be positioned to borrow the $30 million needed to keep it open while private funds are raised. Sen. Jabo Waggoner introduces SB278 to create a mechanism to loan BSC the needed funds. The bill is written with BSC’s situation in mind.

- In May 2023, the Senate passes SB278 and BSC begins sharing documents with the Treasurer. The House passes the Senate bill despite the Treasurer lobbying against it.

- On June 6, the Treasurer visits the BSC campus and expresses a desire to subordinate ServisFirst’s position with respect to existing debt.

- On June 16, Gov. Ivey signs the Distressed Institutions of Higher Learning Revolving Loan Program Act into law after adding Executive Amendments, which were accepted by the House and Senate.

- In July, the Treasurer tells President Coleman he is requesting an Attorney General’s opinion on the Act prior to formally launching the program. He indicates the College’s restructuring plan is what he needs for now.

- On July 14, a copy of the loan application is posted to the Treasurer’s website. When BSC inquires as to whether their application should be filed electronically or in hard copy form, the school is told the application was posted to the web inadvertently and it is taken down.

- On August 24, the Attorney General declines to issue an advisory opinion and The Treasurer announces he will accept applications. The new application is unchanged since the inadvertent posting more than a month earlier. BSC files their application the same day.

- On August 28, the Treasurer tells Coleman he “wish(es) we had gotten (the loan processed) in July.”

- On September 6, the Treasurer asks Coleman why BSC isn’t applying for the full $30 million originally contemplated when the Act was written and encourages him to apply for the full amount.

- On October 5, the Treasurer again raises the issue of BSC’s relationship with ServisFirst and says for the first time ever that he thinks ServisFirst should be the entity loaning money rather than the State. The statement is completely unexpected.

- On October 13, the Treasurer tells Coleman that he is not inclined to make the loan and states that ServisFirst should do so — this even though the only changes from the time The Treasurer said he wished the loan could have been finalized sooner are improvements in the collateral offered the State.

- On October 18, after receiving a letter from the Treasurer dated October 13 in which he denies the loan application, BSC is forced to file a lawsuit to protect its rights and compel The Treasurer to act in accordance with the intentions of the Legislature in passing the Act.

In Summary

We are uncertain why the Treasurer has mischaracterized the events of the past several months. Certainly, the Treasurer has many duties for which he is responsible, but for months now the question of a loan for BSC has been the primary preoccupation of the College administration. We have paid close attention to every development and taken careful notes at every turn.

The Treasurer has determined he will not extend a loan to BSC as the Legislature intended when it conceived and wrote the Act. But he at least owes Alabamians the full and honest truth.

Here’s the statement released by the treasurer’s office over the weekend, responding to BSC’s accusations against the treasurer:

State Treasurer Responds to Birmingham Southern Statement

MONTGOMERY – On October 25, 2023, Montgomery County Circuit Court Judge James Anderson dismissed Birmingham Southern College’s case seeking to compel Alabama State Treasurer Young J. Boozer III to execute the Distressed Institutions of Higher Learning Revolving Loan Fund Act, passed on June 6, 2023, and signed into law by Gov. Kay Ivey on June 16, 2023.

The following is a response from the Alabama State Treasurer’s Office to a statement from Birmingham-Southern College President Daniel Coleman. Last week President Coleman lost his lawsuit in circuit court against the Treasurer. He now attempts to deflect blame and attack the Treasurer’s character in the court of public opinion.

“I am disappointed with the incendiary rhetoric of President Coleman. He falsely claims that I acted arbitrarily or capriciously, or in bad faith, or misinterpreted the law in question. I did not. President Coleman is wrong,” said Treasurer Boozer.

Good faith was not betrayed over the several months of working with President Coleman to attempt to deliver this bridge loan to the College. The Treasurer’s previous press releases show the activities undertaken and their timing. President Coleman was informed of them as they took place. Based on the true timeline there is no evidence that the Treasurer’s behavior was arbitrary and/or capricious.

The facts will show that any delays President Coleman encountered were dealing with the current fully collateralized and secured principal lender. Any misinterpretation of the language of the Act pertaining to collateral lies with the President because it comports with his desired narrative. The Treasurer has known and understood the Act since June 6, 2023.

The bill was conceived and written to allow for a $30 million fund for a college or many colleges providing operating funds for a term of time during which the college could raise an endowment to ensure its long-term financial stability. BSC has stated that in spring 2023, its Board of Trustees received assurances from unnamed legislative leaders supporting a measure to provide bridge funding that, should the bill pass, the College would be positioned to borrow $30 million in bridge funding required to keep it open. Those assurances were given in the absence of the legislative leaders knowing the true creditworthiness of the applicant or any terms and conditions that the Legislature would include in a law.

As required by the law, the Treasurer conducted a careful and thorough investigation of the creditworthiness of BSC and its ability to repay the loan.

The Treasurer told President Coleman on October 13, 2023, during a lengthy phone conversation that began at 1:37pm that the loan was denied. President Coleman understood the statement. The confirming letter was dated October 13, 2023, and sent. President Coleman reported that it arrived on October 18, 2023, and claims it informed him for the first time that the loan was denied.

At the beginning of months of discussions, the Treasurer told President Coleman the college did not meet the collateral requirement in the statutory minimum requirements and that the first perfected security interest could not be attained without the existing principal lender subordinating. The Treasurer’s actions and requirements were directed by the law as passed and were always according to the actual law.

Since then, the Treasurer has never wavered from the denial based on insufficient collateral and the lack of a first perfected security interest in all collateral assts. Contrary to the statement of President Coleman, the Treasurer has not stated that the College was “not a good credit risk,” but instead, has stated that the college is a “terrible credit risk.” The college’s Moody’s credit rating of Caa2 confirms it to be a junk bond, one step above default.

For more on Birmingham-Southern College, click here.

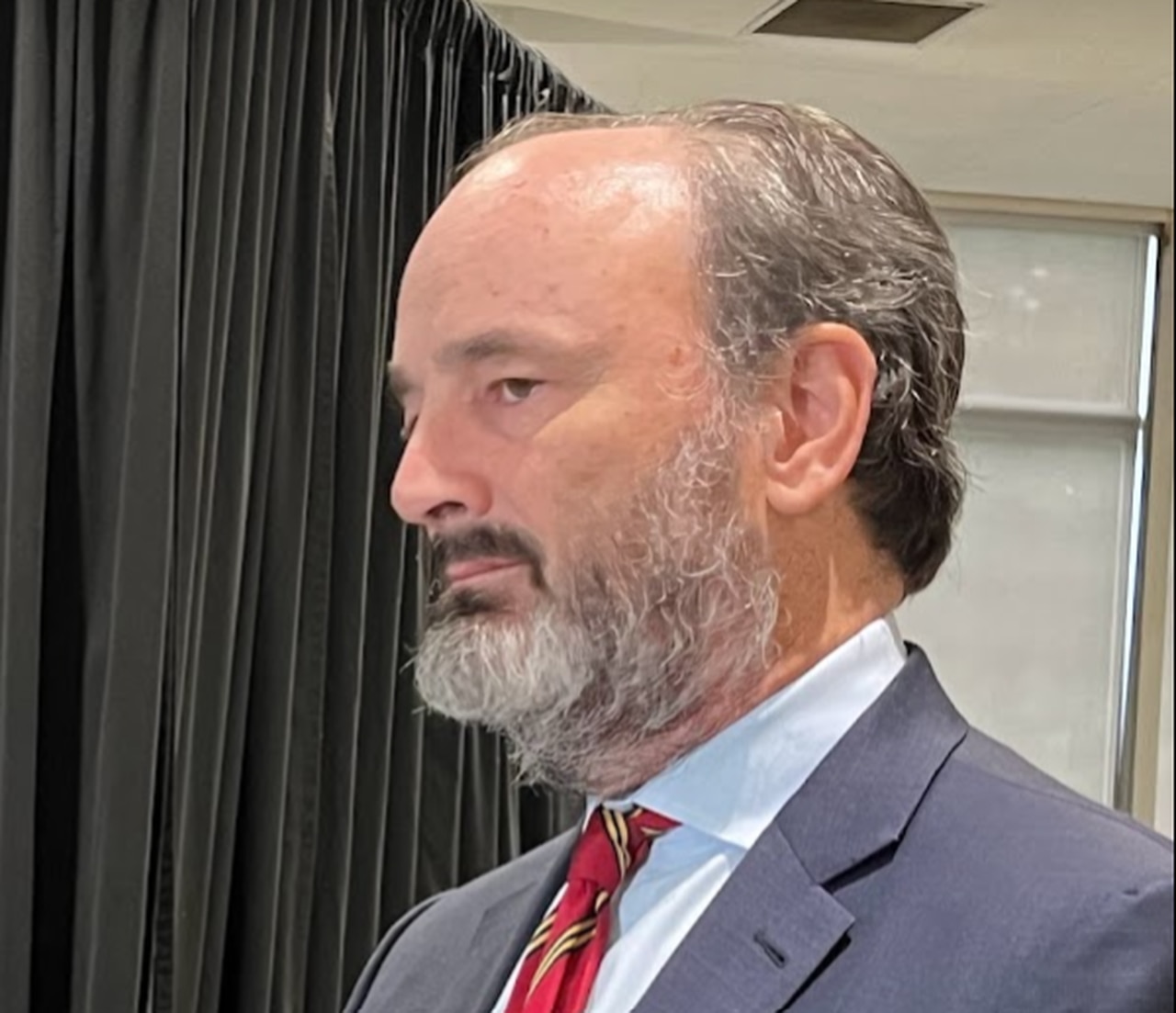

Birmingham-Southern College President Daniel Coleman said in a letter to alumni and supporters on Oct. 27, 2023 that the college is exploring “every option.” (Photo by Greg Garrison)[email protected]