Alabama faces decisions for $2.7 billion in unexpected education funds

The time is drawing closer for Alabama to decide how to use $2.7 billion in tax revenue for education that the state was not expecting.

The Legislature passed a $7.7 billion budget for the last fiscal year, which ended Sept. 30, but the state raked in $10.4 billion in income taxes, sales taxes, and other revenues that support the Education Trust Fund. Lawmakers and education officials say it’s important to make good choices about what to do with the unexpected money.

It’s not unusual for the state to take in more revenue than it budgeted. Every year, that money goes to a stabilization fund to hold for leaner times and an advancement and technology fund that can be used for certain purposes.

But the amount left over last year was extraordinary. Officials have attributed it, in part, to the billions Congress sent to the state in COVID-19 relief packages like the CARES Act and the American Rescue Plan Act. They don’t expect such large surpluses to become the norm.

Legislative leaders have said there is a strong chance for a tax rebate, a one-time payment to taxpayers. They have also talked about permanent tax cuts. Lawmakers have urged caution, saying the surplus is not expected to recur and because of uncertainty about the economy, a possible recession, and its effect on tax revenues.

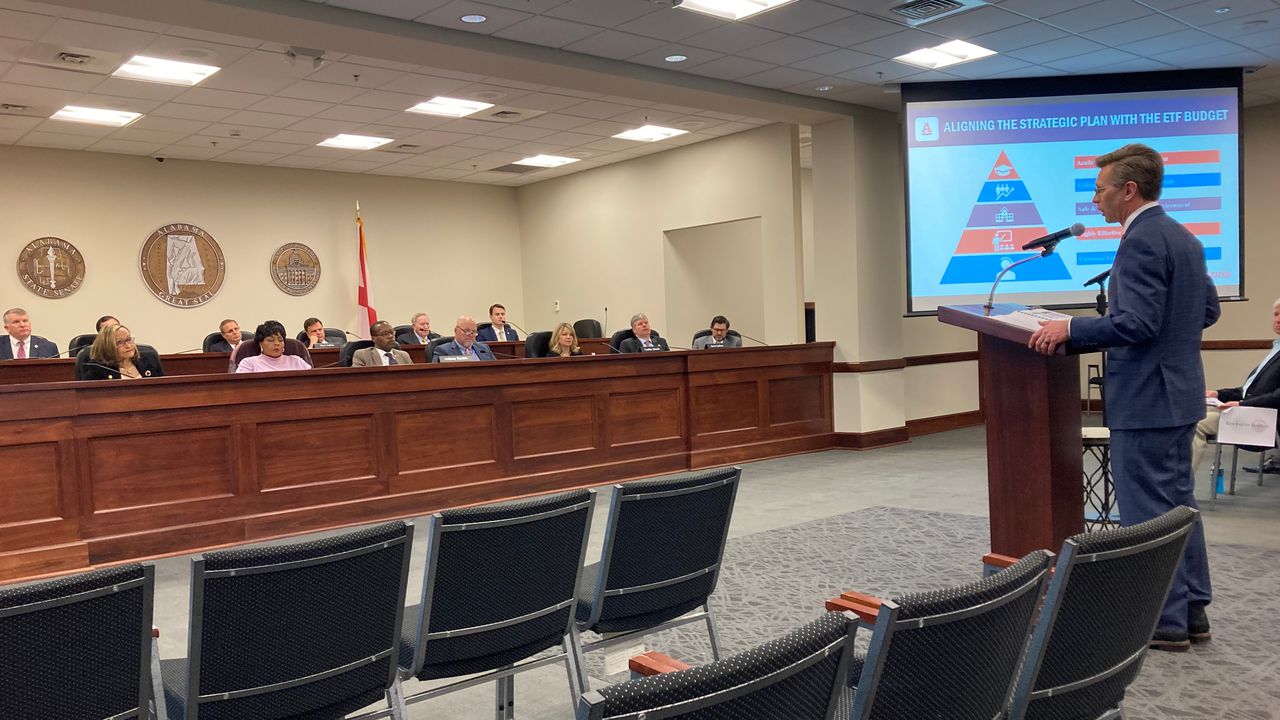

The Legislature’s education budget committees held a hearing Thursday and heard from state Superintendent Eric Mackey, the Alabama Commission on Higher Education, the Department of Early Childhood Education, and the Commission on the Evaluation of Services.

Mackey gave a slide show presentation on the state Board of Education’s budget request for next fiscal year. He included a separate, supplemental request from the $2.7 billion surplus. The largest portion of that supplemental request was $500 million for school construction.

The Legislature passed a $1.25 billion bond issue for school construction in 2020 during the early portion of the COVID-19 pandemic.

“The problem is construction costs have gone up so much that we cannot fund the projects that were anticipated,” Mackey said. “So we’ve asked for $500 million of that surplus money to go to construction projects.”

Mackey’s request from the $2.7 billion surplus included $40 million for new school buses. It included $24 million for summer math camps required under the Numeracy Act, an initiative approved by the Legislature last year to put more resources and people into teaching math in the earliest grades.

Mackey requested $25 million to support a college and career ready initiative that adds a requirement for a high school diploma starting with the Class of 2028. The state Board of Education approved the requirement in November. Students have a number of ways to show they are ready for college or to enter the workforce, such as earning a qualifying score on the ACT college entrance exam or earning a career tech industry credential.

The superintendent requested $10 million from the surplus funds for school safety. Overall, Mackey said he was requesting about $750 million in supplemental funds.

“Now that leaves about $2 billion on the table,” Mackey said. “We have been working with the governor’s office about how some of that money could be invested this year and long term in schools, but I don’t have any specifics on that.”

Rep. Danny Garrett, R-Trussville, chair of the House education budget committee, said after today’s hearing that lawmakers still had much to consider as they decide how to use the $2.7 billion.

“We’re gathering facts,” Garrett said. “I’ve drawn no conclusions. I think that we need to be very strategic in how we use the money, very wise in how we use the money. The areas of the state that we need to invest in to generate improvement and improve education outcomes throughout the state, we need to pay close attention to those and evaluate all those opportunities.”

Sen. Arthur Orr, R-Decatur, chair of the Senate education budget committee, said last month he expected proposals for tax rebates totaling up to about $500 million.

“We believe, after we take care of state government, at least on the education side, we have enough to send back to the people of Alabama, who sent it to us in the first place,” Orr said during the Legislature’s organizational session in January. “In addition to that, with the economy and with inflation, they’re struggling. So, this would be a small matter of relief to them.”

Garrett said today a rebate would be part of the discussion about how to use the surplus, as well as possible tax cuts.

“I’m not opposed to the concept of a tax rebate,” Garrett said. “We’re beginning to hear some people in districts, particularly in the rural areas, push back a little bit and say we would rather have the money in our schools. We would rather have the money invested locally.

“So we’ll have those discussions. I think we’re going to continue to do measured tax cuts as we’ve done every session pretty much for the last several sessions. And continue to keep our state a low tax state. At the same time do what we can to incent economic development, business development here. I think all that’s on the table. We’ll discuss all of that. But my philosophy is we need to be very wise and fiscally responsible what we do with the surplus.”

The legislative session begins March 7.