More states teach financial literacy. It might help students struggling with math

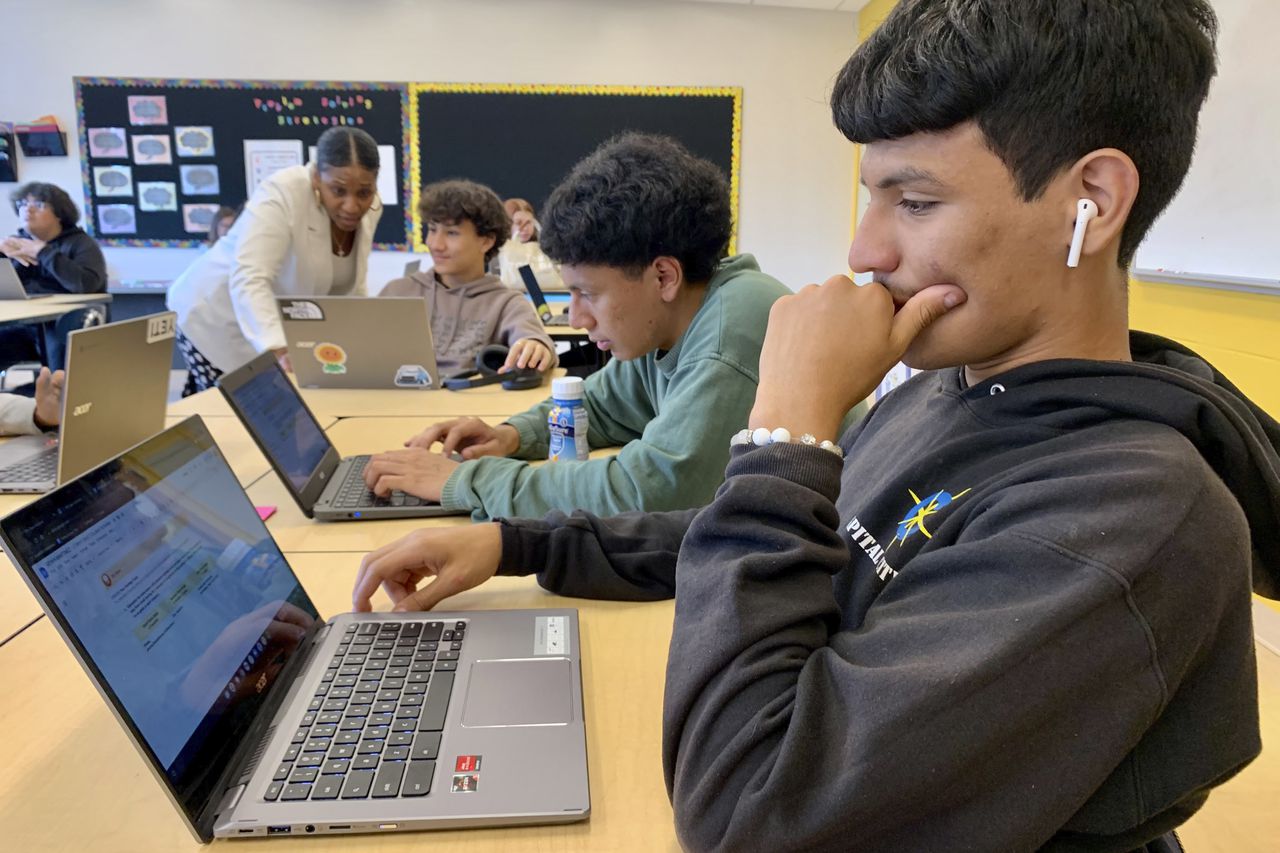

Inside a high school classroom, Bryan Martinez jots down several purchases that would require a short-term savings plan: shoes, phone, headphones, clothes, and food.

His medium-term financial goals take a little more thought, but he settles on a car — he doesn’t have one yet — and vacations. Peering way into his future, the 18-year-old also imagines saving money to buy a house, start his own business, retire, and perhaps provide any children with a college fund.

Martinez’s friend next to him writes a different long-term goal: Buy a private jet.

“You have to be a millionaire to save up for that,” Martinez says with a chuckle.

Read more from this series: To improve at math, these Alabama students got more instructional time.

Call it a reality check or an introduction to a critical life skill, this exercise occurred in a course called Advanced Algebra with Financial Applications. The elective math class has been a mainstay in Capital City Public Charter School’s offerings for more than a decade, giving students a foundation in money management while they hone math skills. Conversations about credit, investments, and loans, for instance, intersect with lessons on compound interest, matrices, and exponential equations.

The Washington, D.C., charter school may be a front-runner in providing financial education, but in recent years, many others have followed suit. Since 2020, nine U.S. states have adopted laws or policies requiring personal finance education before students graduate from high school, bringing the total number to 30 states, according to the Council for Economic Education.

The surge comes as educators are scrambling to bolster students’ math skills, which plummeted during the pandemic and haven’t fully recovered. At the same time, a general dislike for math remains an obstacle among young people.

But do topics like high interest rates translate to higher interest among students? Tonica Tatum-Gormes, who teaches the course, says yes. She attributes better student engagement to them seeing the connection between math and their future financial well-being.

Students begin to understand that “yes, I need to learn decimals, and I need to learn fractions, and I need to learn percentages because I have to manage my money and I have to take out a loan,” Tatum-Gormes says.

Advocates say personal finance courses could pay dividends if students learn how to make wiser money decisions and avoid financial hazards. In the process, they may also develop an interest in math because of its practical applications.

The K-12 standards for personal finance education, as recommended by the Council for Economic Education, include topics such as earning income, budgeting, saving, investing, and managing credit and financial risk. Experts say it’s a course that doesn’t necessarily have to be taught by a traditional math teacher.

“The more math you add to financial literacy, frankly, the better it is,” says Annamaria Lusardi, founder and academic director of the Global Financial Literacy Excellence Center. “In many cases, to make a decision, you have to do calculations, so I think math is a very powerful tool. … Having said that, financial literacy is more than math.”

Idaho is one of the states where a new financial literacy curriculum is hitting classrooms. The state Legislature this year approved the course as a graduation requirement.

The new course will give students the chance to apply skills from their algebra, calculus, and economics classes to their real lives — computing their future student loans, rent payments, and income requirements.

“This was such a priority out of the gate because I heard from so many people during the campaign last year that our young people weren’t prepared with the basic financial skills they need to succeed in life,” says Debbie Critchfield, Idaho’s state superintendent of public instruction, who spearheaded the effort.

Experts say the subprime mortgage crisis that helped spark the Great Recession in 2007, followed by pandemic economic uncertainty and today’s inflationary period, may have heightened Americans’ desire for a solid financial understanding. Less than a quarter, or 24%, of millennials demonstrate basic financial literacy, according to the Council for Economic Education.

Advocates say that left untaught, teens and young adults may turn to questionable sources, such as TikTok or YouTube videos. Plus, children whose parents aren’t financially savvy can’t rely on learning at home, making it an equity issue.

In 2020, the NAACP issued a resolution calling for more financial literacy programs in K-12 schools.

In schools with predominantly Black and Hispanic student populations where there are no state-mandated requirements, only 7% of students have guaranteed access to at least a semester-long personal finance course. That figure rises to 14.2% for schools with less than a quarter of students identifying as Black or Hispanic, according to an analysis by Next Gen Personal Finance, a nonprofit that advocates for financial literacy education.

The equity consideration has been a driving force behind the financial literacy course at Capital City Public Charter School, which serves a student body that is 64% Latino and 25% Black.

“It’s an empowering course,” says Laina Cox, head of the school. “I think it gives our young people the language that they need and the voice when they’re in certain rooms and at certain tables.”

In Tatum-Gormes’ classroom, the conversation about savings goals turns into a math problem on the whiteboard. She’s asking students to calculate how much someone would need to save to create an emergency fund covering three months’ worth of expenses.

At her nudging, students piece together an equation, which she scrawls on the board. It’s early in the school year, but for students, the value of the dollar is already becoming apparent.

Martinez, who’s one of nine children, says he signed up for the course because he watched his parents struggle to make ends meet. He hopes that he walks away with knowledge about when to spend — and not spend — money.

“I just want to prepare myself for the things that are coming toward me,” he says.

___

Sadie Dittenber from Idaho Education News contributed to this report.

___

The Education Reporting Collaborative, a coalition of eight newsrooms, is documenting the math crisis facing schools and highlighting progress. Members of the Collaborative are AL.com, The Associated Press, The Christian Science Monitor, The Dallas Morning News, The Hechinger Report, Idaho Education News, The Post and Courier in South Carolina, and The Seattle Times.