Student loan forgiveness: SAVE, new income-driven student loan repayment program, live now

The Biden administration has officially unveiled its new income-driven student loan repayment plan known as SAVE.

The Saving on a Valuable Education, or SAVE Plan, calculates payments based on a borrower’s income and family size as opposed to their loan balances and forgives debt after a certain number of years. The plan will cut many borrowers’ monthly payments to zero and will save other borrowers around $1,000 a year, according to a White House statement.

“Starting today, millions of borrowers can reduce their monthly student loan bills by enrolling in the SAVE plan, the most affordable repayment plan in history,” Education Secretary Miguel Cardona said in a statement. “The SAVE plan is another huge step forward in President Biden’s tireless efforts to fix the broken student loan system, reduce the burden of student debt on working families, and put borrowers first.”

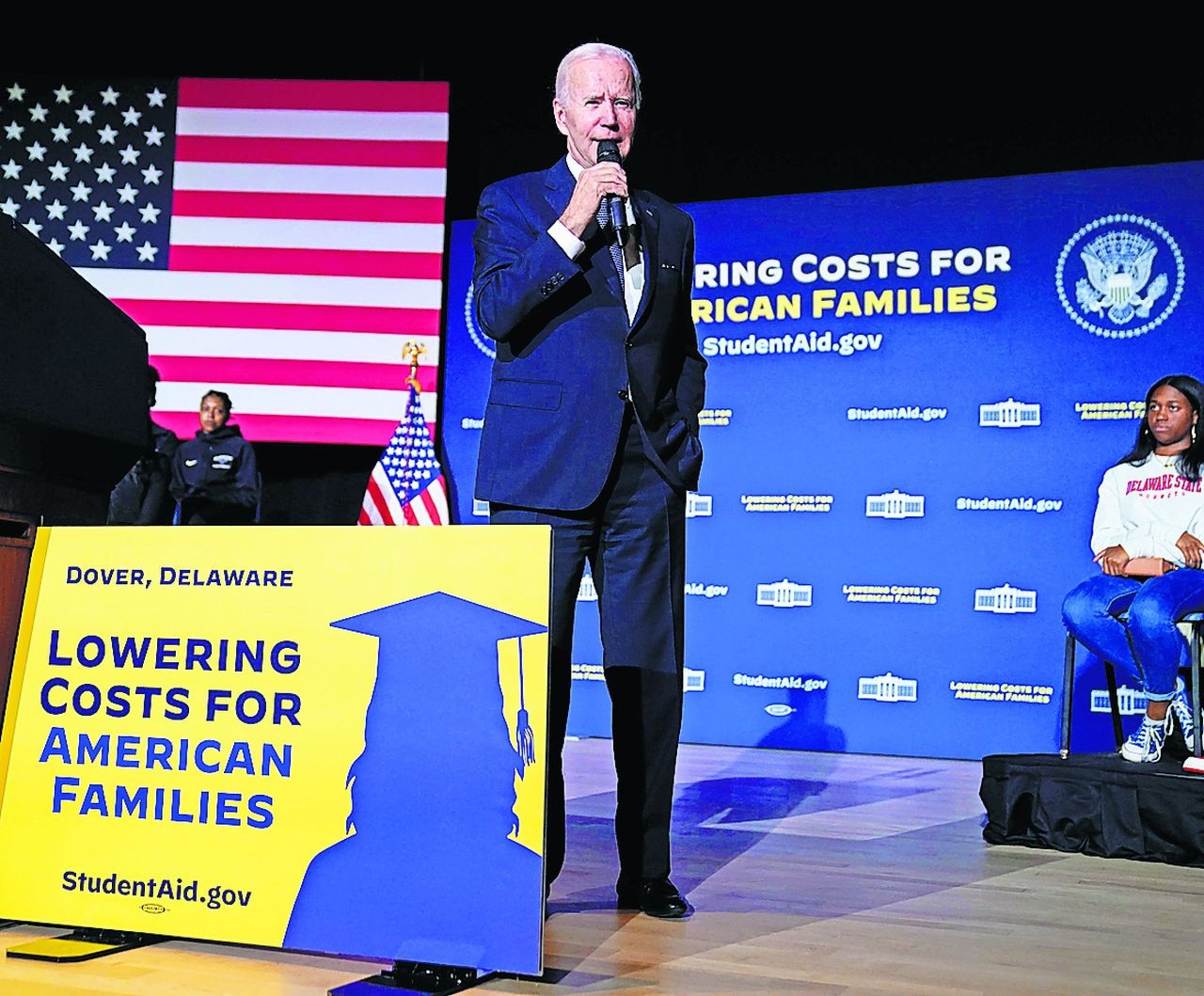

An estimated 20 million borrowers will benefit from the plan, the White House said. Borrowers can sign up starting today with an online application at StudentAid.gov/SAVE.

READ MORE: Student loan forgiveness starts for 800,000 borrowers: Here’s who qualifies

SAVE plan

Under the SAVE plan, borrowers with undergraduate loans will have their payments reduced from 10% to 5% of discretionary income, a change that could slash many payments to zero. For example, under the SAVE formula, a single borrower who makes about $15 a year will not have to make any monthly payments.

Also, no interest will be charged on loan balances not covered by the borrower’s payment on the SAVE plan. For example, if a borrower has $50 in interest that accumulates each month and their payment is $30 per month under the new SAVE plan, the remaining $20 would not be charged as long as they make their $30 monthly payment, the White House explained.

The SAVE plan also allows borrowers whose original principal balances were $12,000 or less to receive forgiveness after 120 payments, the equivalent of 10 years.

Roughly 70 percent of borrowers who were on an IDR plan before the payment pause will benefit from this change. Borrowers who are already on the existing REPAYE plan will be automatically enrolled in the SAVE plan and see their payments automatically adjust with no action on their part.

The launch of the SAVE plan comes just weeks before interest will once again start accruing on student loans after a three-year pause during the COVID pandemic. Payments are set to resume in October.