Alabama’s new tax incentive bills to add more public disclosure

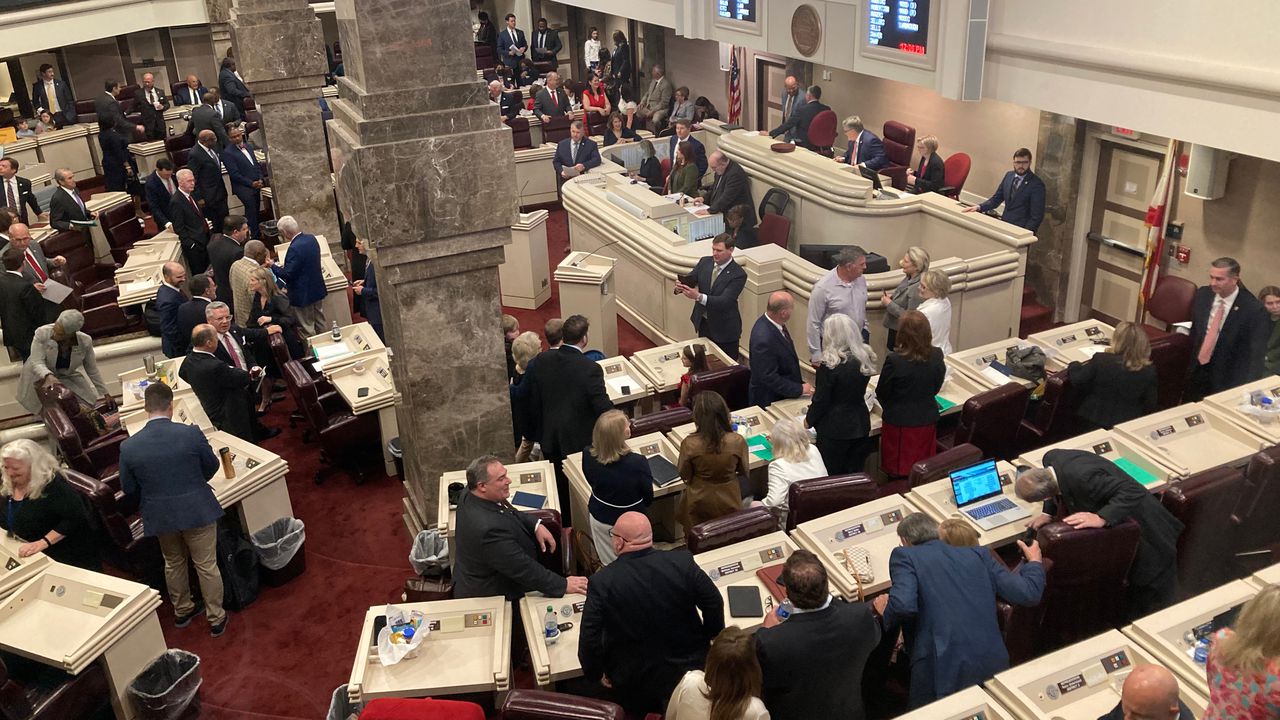

Bills to renew and expand the tax incentives Alabama uses to recruit industry won unanimous approval today in the House of Representatives, continuing to receive broad support as a priority for the legislative session.

The four-bill package renews the Alabama Jobs Act and Growing Alabama Act for five years and increases the caps on benefits that can go to companies. The laws were scheduled to expire in July. The package includes a grant program to evaluate and develop sites for industry and an Innovating Alabama tax credit to help technology companies.

Companion bills are moving in the Senate, which passed two of the four bills, also without a dissenting vote.

Gov. Kay Ivey has named the legislation the Game Plan, and Republican and Democratic lawmakers are sponsoring bills.

One of the four bills, HB240, would require the Alabama Department of Commerce to post on its website specific information about the benefits paid to companies under the Alabama Jobs Act. The information includes the name of the incentivized company; the county of the qualifying project; the estimated capital investment; the estimated number of new jobs; the estimated average hourly wage; the estimated value of the jobs credit; the estimated value of the investment credit; the projected 10-year and 20-year return on incentives; and the value of any cash incentive that was committed.

Lawmakers adjourned this morning to hold a special joint session to recognize the military. The legislative session resumes on Tuesday and continues until June.

This story will be updated.