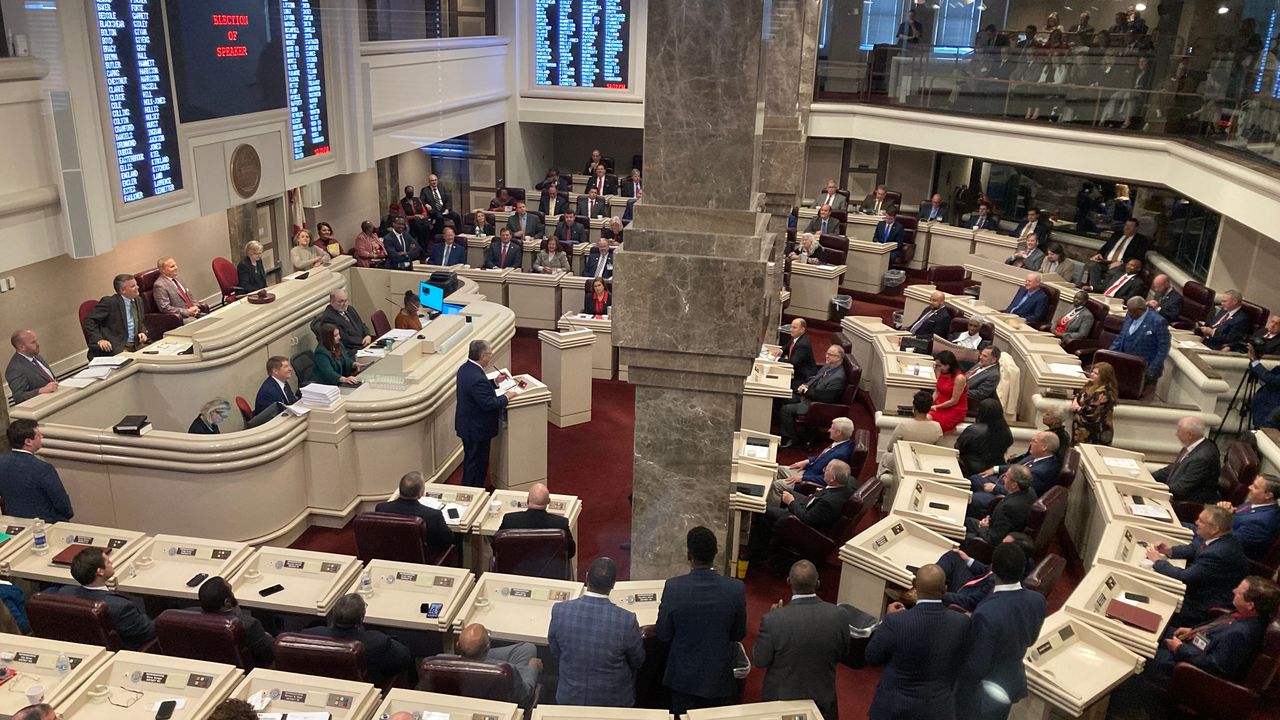

Year of tax cuts in Alabama Where proposals stand in the Legislatur

Family budgets are feeling the pinch of inflation. Alabama, on the other hand, has an unusual surplus for its state budgets. Those are two main reasons state lawmakers are considering tax cuts this year.

Four weeks into the legislative session, lawmakers have introduced about a half-dozen bills that would reduce taxes. None have won final approval but the session will last until June.

Proposals so far include a phase-out of the state sales tax on basic foods, elimination of the state income tax on overtime pay, modest cuts to the income tax, and expansion of a tax exemption for people 65 and older.

Lawmakers have filed bills on Gov. Kay Ivey’s proposal for a one-time, state income tax rebate of $400 for individuals and $800 for married couples. Top lawmakers said this week that legislators will probably consider reducing that amount.

Senate Pro Tem Greg Reed, R-Jasper, was asked on Thursday about the outlook for the repeal of the tax on basic foods, which was introduced by Sen. Arthur Orr, R-Decatur, chair of the education budget committee. Reed talked about the chance for that bill and the overall outlook. He said four topics are on the table, rebates, investing the surplus in key programs, putting more in reserve accounts, and tax cuts.

“Is there a way to take some of the surplus, use it to reduce taxes on the people of the state of Alabama?” Reed said. “And what’s the best methodology to do that? All four of those elements are going to be talked about and are being talked about now.”

Two bills making modest cuts to the state income tax won unanimous approval in the House of Representatives on Thursday. If they pass the Senate and become law, they would save taxpayers an estimated $82 million a year when fully implemented. The House education budget chairman, Rep. Danny Garrett, R-Trussville, is the sponsor.

Alabama taxes income at rates of 2 percent to 5 percent. HB116 by Garrett would eliminate the 2 percent bracket, which applies to the first $500 in income for individuals and the first $1,000 for couples. HB115 by Garrett would gradually cut the 5 percent rate to 4.95 percent over five years. Most income is taxed at the 5 percent rate, which applies to earnings above $3,000 for individuals and $6,000 for couples. Garrett acknowledged that the cuts would be modest and said there is a reason for that.

“One thing we are heavily dependent upon in Alabama are the income and sales taxes,” Garrett said. “Those are very, very volatile taxes. So right now we’re riding a wave where things are going up and tax collections look good. When they turn, it will turn quickly. The most volatile tax is the income tax. That’s 65 percent of our education budget. So you’ve got to be careful when we make cuts that aren’t sustainable that we don’t put our education budget in jeopardy. Because one of our biggest ways to prosperity in the state is to improve education.”

Orr is sponsoring the income tax bills in the Senate. Orr is also sponsoring SB177, which would gradually repeal the 4 percent state income tax on basic foods such as milk, eggs, bread, fresh fruit and vegetables, and infant formula. The exemption would apply to foods that qualify under the federal Women, Infants and Children food assistance program.

Reed said he believes Orr’s bill is based on strong research and a good understanding of how it would affect the education budget. “He understands that we are trying to do the right thing for the people of Alabama as best we can,” Reed said. “At the same time we can’t make poor decisions that are going to cause us real problems in the future, by eliminating opportunities for taxation that are going to be a problem in the future. So I think all the balance of those issues are going to be what we continue to work on in the weeks to come.”

Garrett has introduced Orr’s bill in the House. Garrett said it would reduce revenue to the Education Trust Fund by about $200 million a year.

More proposals to repeal the state sales tax on groceries are coming. Alabama is one of only three states that collects the full state sales tax on groceries. Lt. Gov. Will Ainsworth said Alabama is in a strong position to repeal the tax. Alabama Arise Action, an organization that lobbies for policies to help low-income families, will hold a press conference at the State House on Tuesday to call for a full repeal of the grocery tax. Alabama Arise has advocated for the repeal for decades.

Sen. Merika Coleman, D-Pleasant Grove, will speak at the press conference. Coleman plans to introduce a bill to eliminate the tax on groceries in one step while closing an income tax loophole that overwhelmingly benefits wealthy households, Alabama Arise said in a news release. For years, lawmakers have proposed bills to replace the grocery tax by eliminating the deduction for federal taxes that taxpayers use to reduce their state income tax. The sales tax collected on all food puts more than $600 million a year into the Education Trust Fund, Orr said.

The Alabama House Democratic Caucus has called for a repeal of the tax on food. House Minority Leader Anthony Daniels, D-Huntsville, said families would spend what they save on the tax on other items that carry the state sales tax, replacing at least a large portion of the grocery tax revenue that would be lost.

Daniels is the sponsor of HB217, which would exclude overtime pay from the state income tax. The exemption would apply to full-time, hourly workers. In addition to allowing employees to keep more of the money they earn, Daniels said the idea would help employers who are struggling to find workers.

The overtime bill has been assigned to the education budget committee but has not yet been considered. It has co-sponsors from both parties, including House Speaker Nathaniel Ledbetter, R-Rainsville. Sen. Sam Givhan, R-Huntsville, is sponsoring the bill in the Senate.

Orr and Garrett are sponsoring a bill to increase the exemption on taxable retirement income for people over age 65 from $6,000 a year to $10,000 a year. The exemption applies to withdrawals from 401(k)-type accounts and individual retirement accounts. Income from traditional pensions has been exempt from Alabama’s state income tax for decades.

Lawmakers approved the $6,000 exemption last year. Expanding it to $10,000 it would cost the Education Trust Fund about $14 million a year.

The Legislature approved several other tax cut bills last year. Those included a bill to eliminate the minimum amount businesses were required to pay under the privilege tax, a savings for the estimated 230,000 small businesses that paid the $100 minimum. Another raised the standard deduction that families can use to reduce their state income tax liability.

Inflation has persisted despite efforts by the Federal Reserve. The U.S. Bureau of Labor Statistics said the Consumer Price Index rose 6 percent for the 12 months that ended in February. The Federal Reserve’s target rate of inflation is 2 percent.

The state has budget surpluses because revenues that came in during the last fiscal year exceeded the spending obligations. The Education Trust Fund’s surplus was $2.7 billion, while the General Fund surplus was $351 million, according to the legislative fiscal office.

Read more: Alabama lawmakers consider reducing tax rebate, sending less than $400