$1.4 million in scholarships? Tips on paying for college, finding financial aid

The price of college may be getting steeper, but there are lots of ways to cut down on costs, say some Alabama students.

Lexie Jones, a 15-year-old senior at Thompson High School in Alabaster City, earned $1.4 million in scholarships from at least 20 different colleges this year.

Jones is one of several high-achieving Alabama high schoolers who have secured hundreds of thousands of dollars in financial aid.

It all started with one school, she said, that offered her a merit scholarship before she even got in.

“That kind of gave me that confidence to apply to more,” she said. “It was like I wasn’t even expecting myself to get that, so imagine what I can get if I just keep applying.”

While Jones hasn’t made a final decision about her plans yet, and can’t put all of that money toward one college, she said that collecting a large trove of scholarships helped her compare options and assess the best path for her future.

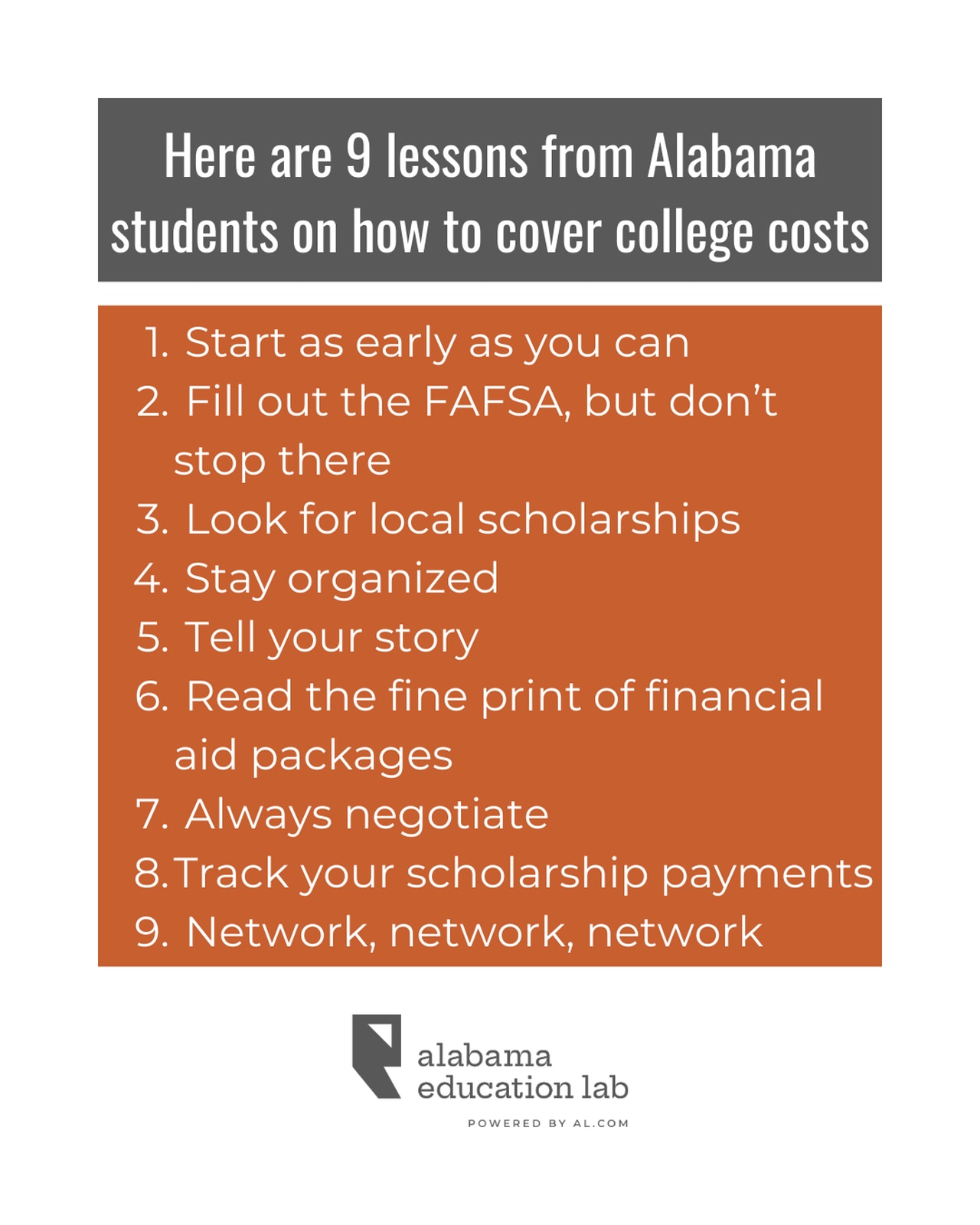

From negotiating offer letters to finding local grants, here’s a list of lessons they learned along the way:

1. Start as early as you can

Shatavia Bellmon, a senior at Ramsay High School in Birmingham who racked up just over a million dollars in scholarships, started scoping out schools the summer before her senior year.

She watched YouTube videos of prospective students, and researched the schools to learn what reviewers were looking for, and what kind of scores she’d need.

Read more: 8 tips for Alabama students working on college applications, from university admissions experts

That also gave her time to boost her ACT score, making her more eligible for merit scholarships.

Depending on your school, you may be eligible for multiple testing waivers or free test prep.

But money isn’t just attached to good ACT scores. The PSAT test, which is given to high school sophomores and juniors in October, makes students eligible for National Merit awards (and usually, a full ride to college).

That’s how Ariel D. Smith, a University of Alabama at Birmingham graduate and incoming assistant professor at Wake Forest University, earned lots of her financial aid.

She said schools sometimes offer opportunities for students to take the test earlier in high school, so they have additional chances to practice.

2. Fill out the FAFSA, but don’t stop there

Bellmon credits lots of her scholarships to the FAFSA, a federal financial aid form that’s now required for Alabama students to graduate.

She also got her parents to fill out the College Board’s CSS profile, a financial application that can connect students with non federal aid.

Some colleges have a net price calculator, which gives an estimate of how much aid you may qualify for. That’s helpful to know ahead of time, she said, because some may also offer discounts on application fees.

Even if you’re not sure about college plans, filling out the FAFSA as a high school senior will help you check off one box of your college application list and put you in consideration for your college’s aid programs.

3. Look for local scholarships

Local scholarships can add up, and in many cases, you don’t have to be a member of a particular organization to receive an award.

Start with your high school counselor, who is most likely to be aware of local opportunities. Websites like FastWeb can be helpful, too, Bellmon said. Banks and churches also typically offer some level of aid to local students.

Smith said she received $1,500 from Alpha Kappa Alpha Inc., a $4,000 scholarship from the local Kiwanis club, and $3,000 per year from Linly Heflin, a group that supports women pursuing bachelor’s degrees in Alabama.

She even got a scholarship from Burger King, she said.

“I think everybody goes after the national, and they don’t take the time to see what’s in your backyard,” Smith said.

Specific colleges and departments may also offer scholarships, beyond the ones listed on the university’s website.

Summer bridge programs, offered through organizations like LSAMP, The Mellon Foundation, governor’s schools and Upward Bound, allow high school students to take free summer courses for college credit, and may also come with scholarships. Some also provide mentors, or other opportunities that can follow students through graduation.

Bellmon said a Birmingham program called the College Choice Foundation helped connect her with scholarships typically offered to low-income students who met certain academic criteria. The organization also coordinates college visits and offers services like ACT prep and financial literacy.

4. Stay organized

Jones is a visual person, so she keeps a detailed spreadsheet, with all of the colleges she applied to, how much it costs to apply to them, where she applied, the major she applied to, how much in scholarships she’s received, and how much it costs to attend the school.

She also keeps a pros and cons list to keep track of opportunities that schools offer and weigh them against overall costs and aid.

Bellmon used the Common App to keep track of her schools, then kept a separate list of all of the supplemental scholarships she had applied to.

Smith said she didn’t keep an elaborate list or work on applications in advance. But she did make sure to give her teachers at least two weeks to write a letter of recommendation or review an essay. And when deadline day was approaching, she prioritized applications over everything else.

“It was just tunnel vision,” she said. “I knew this had to happen, and it became an all-encompassing obsession.”

5. Tell your story

Before writing a scholarship application essay, learn what the university values and what the particular scholarship is geared toward. That can help you decide whether to focus on community service, or academics, or other aspects of your resume more than others.

Keep a few versions of the same draft, so that you can quickly adapt it to different applications.

Jones recommends the website TheCollegeMind, where students can view sample essays and get free feedback from experts.

Bellmon, an aspiring neuroscientist, found creative ways to connect her high school debate experience, as well as her interest in writing TV plots, to her major.

“Stand out,” Bellmon said. “Don’t just repeat, ‘Oh, I’m a hard worker and I’m in this many clubs.’”

And it’s also OK to use that space to acknowledge the challenges you’ve faced in life, Smith said. Just make sure to note why those experiences are relevant, and try to keep the focus on your strengths.

“There’s nothing wrong with that story at all,” she said. “I just don’t want students to feel like, when they get the scholarship, they only got it because of that. Or that the only way to get scholarships is that you have to be poor.”

6. Read the fine print of financial aid packages

Students should check to see if their scholarships are one-time awards. And not all recurring scholarships last all four years, either.

Some also may come with conditions, like meeting a certain GPA, maintaining a set amount of credit hours or taking on research or work study responsibilities.

Smith said she had to learn that the hard way.

“I think that’s one of the biggest pieces that actually trips a lot of students up is that we hype them up about getting scholarships their junior, senior year of high school so that they can go to college,” she said. “We fail to talk to them about the fine print.”

Graduate students on fellowships should take a look at benefits like health care options, which may differ depending on the school or type of offer.

Also, know where the money is coming from. A fellowship tied to a particular grant or project that a professor is doing may not be as stable as funding that comes straight from the department.

And be careful about binding agreements, like early decision plans.

If you’re applying to a highly competitive school and are confident they will meet 100% of your financial need, go ahead and apply as early as possible to increase your chances of getting in, Bellmon said.

For others, it’s OK to take your time. Admissions officers may be more likely to sweeten the deal if they know you have other options.

7. Always negotiate!

Jones said when she’s applying to a college, she’ll look at all the scholarships they list on their website. If she meets a scholarship’s criteria, she’ll send an email to the school’s advisor or admissions counselor.

“They’ll rarely give you the best option first,” Jones said. “You’re gonna have to fight for it in most scenarios.”

Sometimes it may take a few calls, or even an in-person visit.

Smith, after learning a college wouldn’t let her stack her scholarships, laid out her other options to an admissions officer. Suddenly, the university came back and offered her one grant, then another.

In graduate school, she negotiated with administration to increase her funding, and was also able to receive a discount on her final summer courses.

“We’ve long been in a space where we’ve conditioned these students to believe that they’ve got to get picked by the school,” she said. “No, you’re picking that school just as much as they pick you.”

8. Track your scholarship payments

Don’t trust that a scholarship will go directly to your bank account, Smith said.

It’s possible that a check in the mail got lost in transit, or was sent to the wrong address. In other cases, departments may hold on to it. Others may not have received important paperwork to finalize a payment.

In these cases, it’s always better to call someone at the front office. Then, follow up over email so that you have a paper trail of the discussion.

9. Network, network, network

If you’re looking for an on-campus job, don’t stop at work-study programs. Some student organizations may offer stipends. Other academic programs may offer financial incentives for good grades.

And get comfortable talking with college counselors and alumni groups, Smith said. You could be the next recipient of a new scholarship or grant, simply because you struck up a conversation with the right person.

In graduate school, Smith said she sometimes wrote her own grants to supplement her research, and built relationships with faculty to see those projects through.

“It’s kind of like when we tell adults to build a relationship with your bank because you never know when opportunities may come through,” she said. “It’s that same mindset.”

To recap:

Infographic Kalyn Dunkins/AL.comAL.com